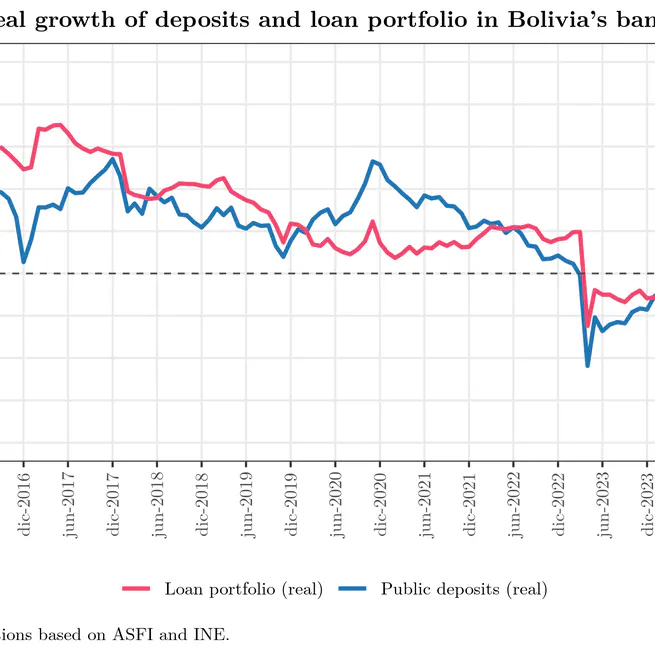

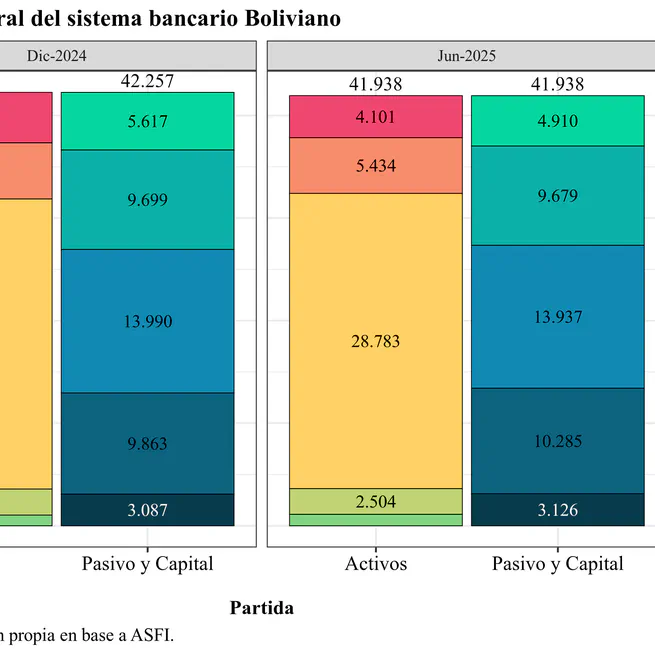

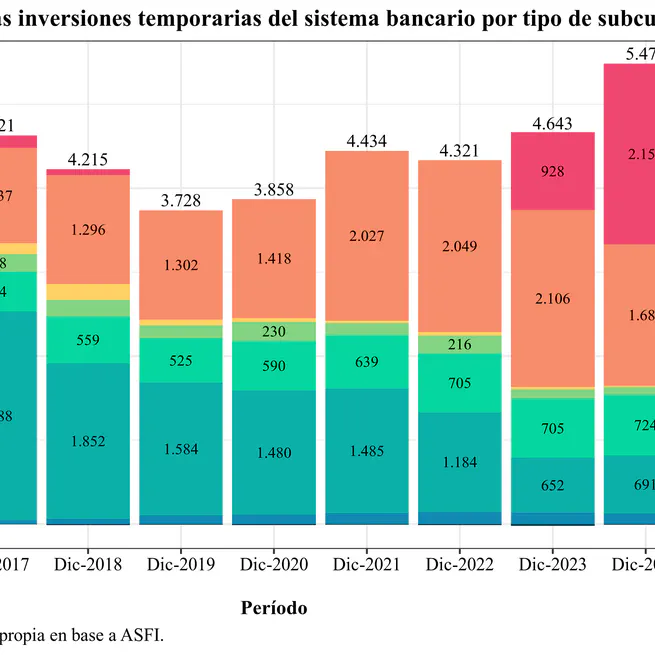

As of September 2025, the Bolivian banking system is operating in a defensive mode amid a fragile macroeconomic environment: the balance sheet expanded by +3.6% in nominal terms (≈ USD 1.479 billion at the official exchange rate), but credit and deposits contracted in real terms. Growth is concentrated in short-term liquid assets —cash and temporary investments— with greater exposure to the BCB and a rebound in account 124 (TGN), while loan portfolio growth has slowed. Funding has become more volatile, with a declining share of time deposits and increased reliance on savings and current accounts, in a context of USD scarcity and a “dual” exchange market. Asset quality remains under strain due to the reprogrammed portfolio (~15%), the main driver of non-performing loans. Despite a positive and recovering ROE, margins are under pressure (regulated lending rates and the need to raise deposit rates), reflecting reduced financial intermediation and growing dependence on the BCB for liquidity management.

Oct 30, 2025

As of June 2025, the Bolivian banking system maintains a defensive strategy in response to a deteriorating macroeconomic environment. Balance sheet expansion is concentrated in temporary investments, mainly in instruments issued by the BCB and now also by the TGN, to the detriment of credit, whose growth is slowing and showing higher risk, especially in reprogrammed loans. Bank funding is becoming more volatile, with less reliance on term deposits and increasing dependence on savings and checking accounts. Although profitability is improving, it is doing so through low-risk, highly liquid assets, reflecting reduced financial intermediation and growing dependence on the BCB.

Aug 1, 2025

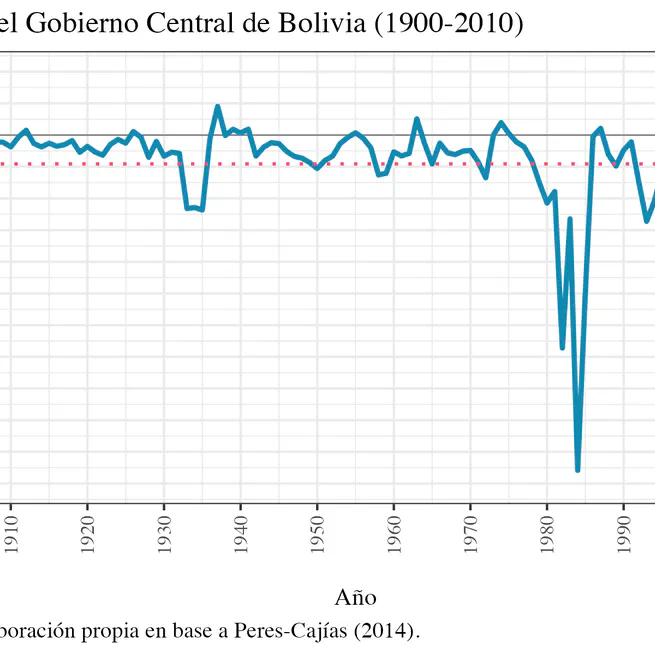

In recent years, Bolivia has experienced a persistent inability to maintain fiscal balance, exacerbated by its dependence on extraordinary revenues from natural resources. Moreover, in recent months, inflation has accelerated, surpassing double digits. This post analyzes, from a historical perspective, how recurring fiscal deficits and their financing through the Central Bank have contributed to inflationary cycles. Based on this diagnosis, two concrete proposals are presented—a fiscal rule and the reform of Article 22 of the BCB Law—as complementary measures to strengthen macroeconomic sustainability.

May 20, 2025

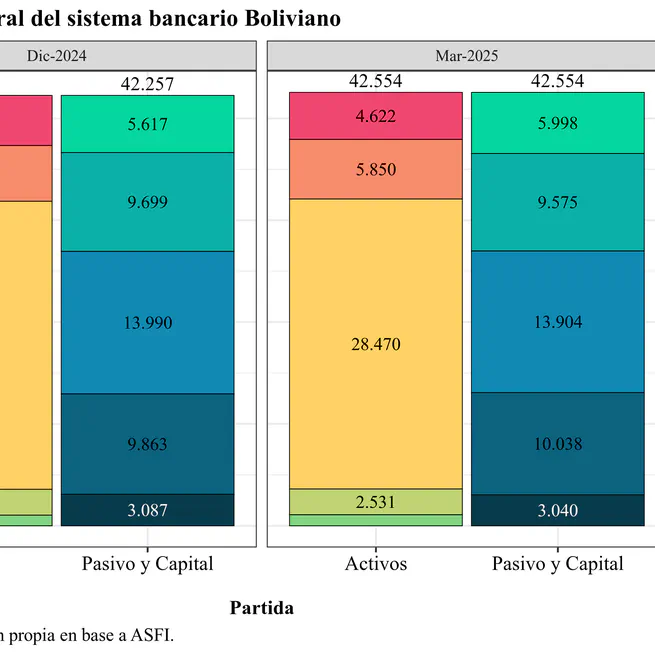

As of March 2025, Bolivia's banking system shows clear signs of a short-term-oriented strategy in response to a challenging macroeconomic environment. Balance sheet expansion has focused on temporary investments, particularly in instruments issued by the Central Bank (BCB), reflecting increased liquidity channeled to that institution. Meanwhile, credit portfolio growth has slowed (5.4% annually), and banks face challenges in attracting time deposits, relying increasingly on current and savings accounts, which are more volatile and sensitive to confidence shocks. Delinquency remains high and is concentrated in rescheduled loans, still representing around 15% of the total. While system profitability has improved, it has done so by leveraging low-risk, highly liquid placements, suggesting reduced financial intermediation to the real economy. Overall, the system is protecting itself, prioritizing liquidity, but sacrificing credit depth in a context of structural fragility and growing dependence on the BCB.

May 2, 2025

Bolivia is facing a progressive economic crisis that is increasingly reflected in its financial system. The banking sector’s balance sheet expanded by USD 1.443 billion in 2024, driven by an increase in local currency liquidity and a slowdown in credit portfolios (5% annual). Banks have increased their liquidity by shifting funds from temporary investments to cash holdings, while their dependence on the Central Bank of Bolivia (BCB) continues to rise. Deposits are still growing, albeit at a slower pace. Non-performing loans have slightly decreased to 3.2%, but remain elevated, with 15% of the portfolio still under restructuring. Profitability is gradually improving but remains below pre-pandemic levels. However, persistent macroeconomic fragility—marked by twin deficits, a dollar shortage, and high inflation—poses significant risks to the financial sector’s stability and its ability to fund the real economy.

Feb 21, 2025