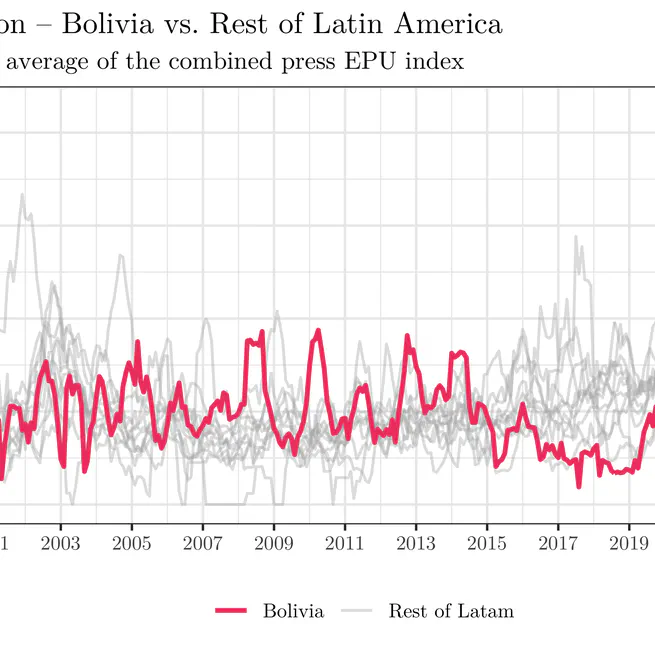

In this post I analyze the Economic Policy Uncertainty (EPU) Index recently published for Bolivia and other Latin American countries by the Bank of Spain. Using these data, I explore the recent evolution of economic uncertainty in Bolivia, its comparison with the rest of the region, and its possible relationship with recent political events. The results suggest that Bolivia remains among the countries with relatively high levels of uncertainty, reinforcing the importance of predictable economic policies and institutional frameworks based on clear rules. Reducing discretion in public policy can help strengthen economic confidence and create more favorable conditions for investment and growth.

Feb 4, 2026

As demand for reproducible macroeconomic analysis grows, manually extracting data from international organizations becomes a bottleneck: processes are poorly documented, non-scalable, and difficult to automate. SDMX —the statistical standard adopted by the IMF, ECB, OECD, World Bank, and others— offers a structured solution that makes it possible to find, understand, and extract data consistently through APIs. This post provides a practical introduction to how the SDMX model works, how to identify dataflows, structures, and codelists, and how to build reproducible queries in both XML and JSON. Using examples from the IMF (WEO) and the ECB (€STR), it shows a generalizable workflow for automating macroeconomic series in R, culminating with the use of the imfapi package, which abstracts much of the technical complexity.

Dec 7, 2025

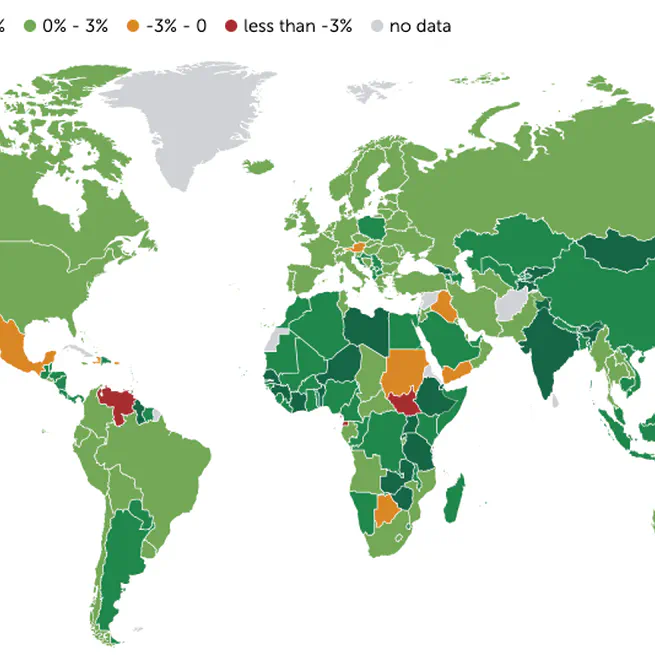

This article shows how to extract economic data from the IMF using its DataMapper API, with `R` functions to organize and analyze information on indicators and countries. Applications are illustrated with Bolivia and Spain, demonstrating how to access structured data such as GDP growth, unemployment, inflation, fiscal balance, and public debt.

Sep 29, 2025

Since late 2023, Bolivia has been experiencing an accelerated and widespread inflationary process, with year-on-year inflation reaching 23.96% in June 2025 and sharp increases in both tradable goods —affected by the dual exchange rate— and non-tradables, as well zas core inflation. The persistent fiscal deficit, financed by the Central Bank through monetary issuance, has weakened the exchange rate regime, eroded institutional credibility, and limited the BCB's ability to control inflation. Without credible fiscal consolidation and the restoration of the Central Bank's autonomy, inflationary pressures will continue to intensify.

Jun 10, 2025

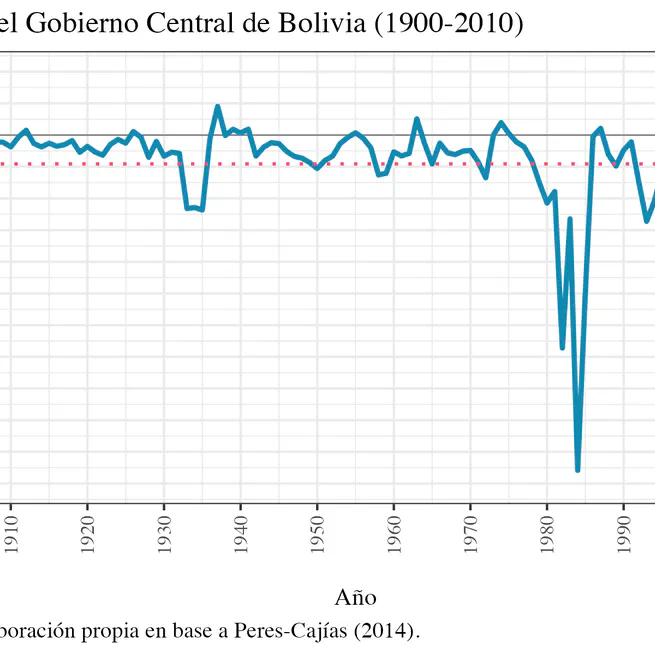

In recent years, Bolivia has experienced a persistent inability to maintain fiscal balance, exacerbated by its dependence on extraordinary revenues from natural resources. Moreover, in recent months, inflation has accelerated, surpassing double digits. This post analyzes, from a historical perspective, how recurring fiscal deficits and their financing through the Central Bank have contributed to inflationary cycles. Based on this diagnosis, two concrete proposals are presented—a fiscal rule and the reform of Article 22 of the BCB Law—as complementary measures to strengthen macroeconomic sustainability.

May 20, 2025

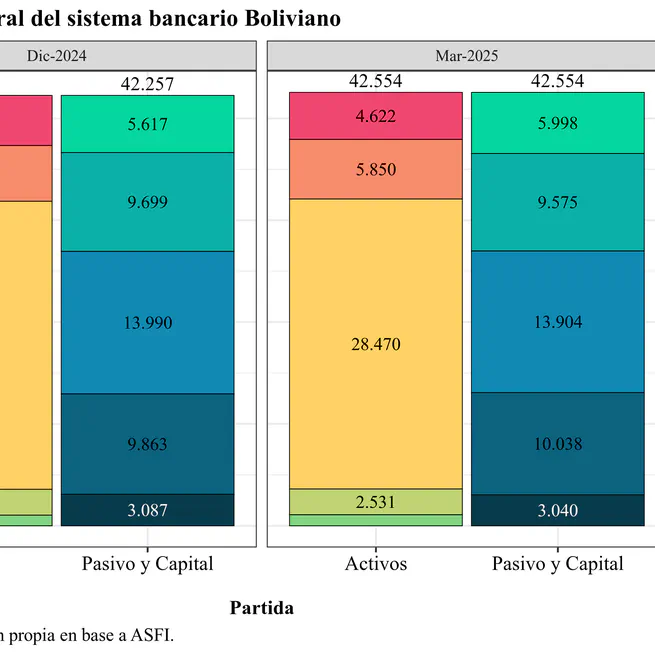

As of March 2025, Bolivia's banking system shows clear signs of a short-term-oriented strategy in response to a challenging macroeconomic environment. Balance sheet expansion has focused on temporary investments, particularly in instruments issued by the Central Bank (BCB), reflecting increased liquidity channeled to that institution. Meanwhile, credit portfolio growth has slowed (5.4% annually), and banks face challenges in attracting time deposits, relying increasingly on current and savings accounts, which are more volatile and sensitive to confidence shocks. Delinquency remains high and is concentrated in rescheduled loans, still representing around 15% of the total. While system profitability has improved, it has done so by leveraging low-risk, highly liquid placements, suggesting reduced financial intermediation to the real economy. Overall, the system is protecting itself, prioritizing liquidity, but sacrificing credit depth in a context of structural fragility and growing dependence on the BCB.

May 2, 2025