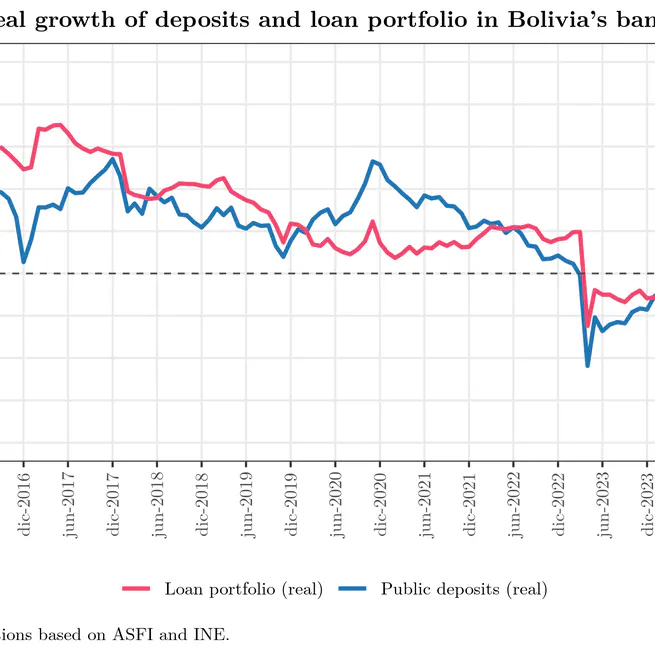

As of September 2025, the Bolivian banking system is operating in a defensive mode amid a fragile macroeconomic environment: the balance sheet expanded by +3.6% in nominal terms (≈ USD 1.479 billion at the official exchange rate), but credit and deposits contracted in real terms. Growth is concentrated in short-term liquid assets —cash and temporary investments— with greater exposure to the BCB and a rebound in account 124 (TGN), while loan portfolio growth has slowed. Funding has become more volatile, with a declining share of time deposits and increased reliance on savings and current accounts, in a context of USD scarcity and a “dual” exchange market. Asset quality remains under strain due to the reprogrammed portfolio (~15%), the main driver of non-performing loans. Despite a positive and recovering ROE, margins are under pressure (regulated lending rates and the need to raise deposit rates), reflecting reduced financial intermediation and growing dependence on the BCB for liquidity management.

Oct 30, 2025

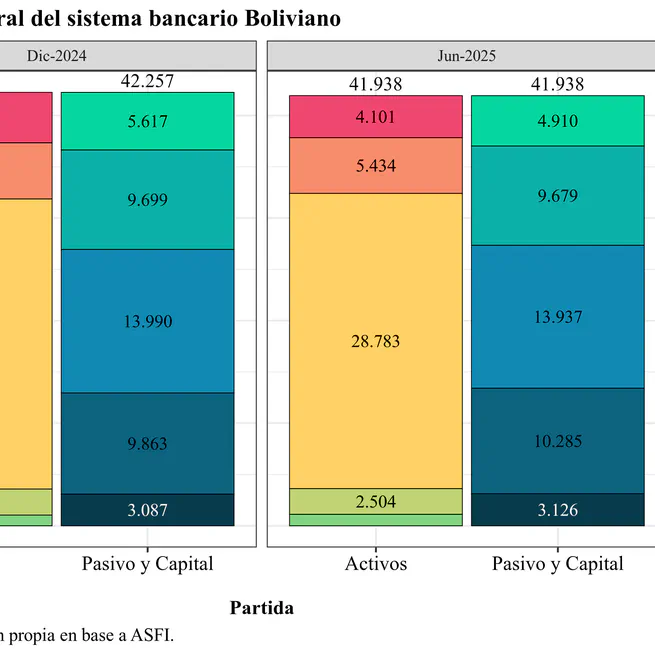

As of June 2025, the Bolivian banking system maintains a defensive strategy in response to a deteriorating macroeconomic environment. Balance sheet expansion is concentrated in temporary investments, mainly in instruments issued by the BCB and now also by the TGN, to the detriment of credit, whose growth is slowing and showing higher risk, especially in reprogrammed loans. Bank funding is becoming more volatile, with less reliance on term deposits and increasing dependence on savings and checking accounts. Although profitability is improving, it is doing so through low-risk, highly liquid assets, reflecting reduced financial intermediation and growing dependence on the BCB.

Aug 1, 2025

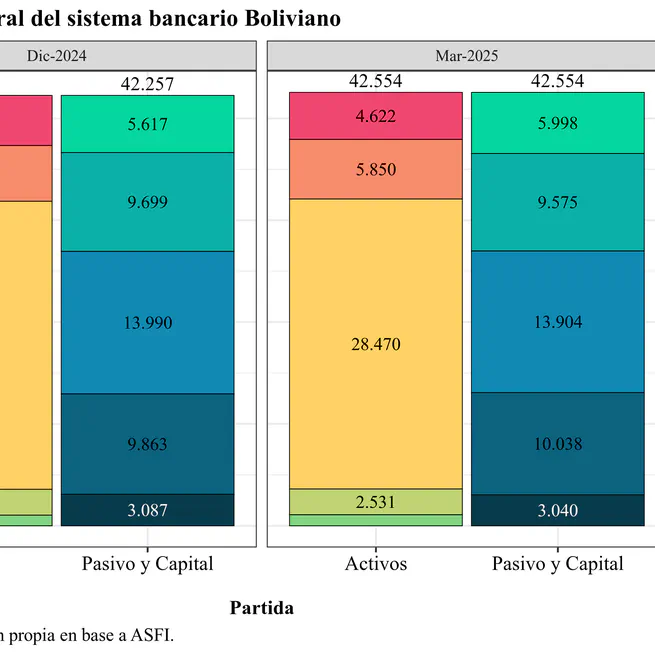

As of March 2025, Bolivia's banking system shows clear signs of a short-term-oriented strategy in response to a challenging macroeconomic environment. Balance sheet expansion has focused on temporary investments, particularly in instruments issued by the Central Bank (BCB), reflecting increased liquidity channeled to that institution. Meanwhile, credit portfolio growth has slowed (5.4% annually), and banks face challenges in attracting time deposits, relying increasingly on current and savings accounts, which are more volatile and sensitive to confidence shocks. Delinquency remains high and is concentrated in rescheduled loans, still representing around 15% of the total. While system profitability has improved, it has done so by leveraging low-risk, highly liquid placements, suggesting reduced financial intermediation to the real economy. Overall, the system is protecting itself, prioritizing liquidity, but sacrificing credit depth in a context of structural fragility and growing dependence on the BCB.

May 2, 2025